Home Healthcare

TABLE OF CONTENTS:

- CH. 1: Introduction

- CH. 2: Market Overview & Trends

- CH. 3: Key Players in the Home Healthcare Business

- CH. 4: Recent Deal Flow and Multiples

- CH. 5: Factors that Drive Business Owners in this Sector to Pursue an M&A Transaction

- CH. 6: What Buyers Look for in a Home Healthcare Business

- CH. 7: What to Consider Before Selling Your Home Healthcare Business

- CH. 8: Key Considerations for Growing Your Home Healthcare Business Through Acquisition

- CH: 9: How to Raise Capital for Your Home Healthcare Business

Chapter 1

Introduction to the Home Healthcare Sector

The market for home healthcare services is growing rapidly, with Global Market Insights forecasting a 7.9% compound annual growth rate (CAGR) from 2022 to 2032, bringing the global market to an estimated $565 billion. While a handful of players account for a good percentage of industry revenues, it’s still a relatively fragmented market that’s ripe for consolidation. That makes the home healthcare sector highly appealing to investors.

If you own a successful home healthcare company, you might have questions about how the market is trending, whether now is a good time to sell or recapitalize your business, and what to consider before taking your company to market. This guide can help.

In this guide to M&A in the home healthcare sector, we discuss the demographic and consumer behavior trends that are driving the industry’s growth and why investors are attracted to this sector. The guide also reviews recent home healthcare deal activity and the most active strategic and financial acquirers, explains what buyers look for in a home healthcare target business, and what to consider before selling your company. The guide concludes by offering guidance for owners who are looking to raise capital for a home healthcare business, then explains why Forbes is the partner that can lead you to an exceptional outcome.

Chapter 2

Market Overview & Trends

The home healthcare sector comprises a diverse range of businesses that provide home health and home care services and products. These offerings span the spectrum—from medical care provided by a licensed health professional to non-medical care and daily living assistance provided by a home health or home care aide, to products used to treat an illness or injury or to monitor a patient’s condition.

Though the 10 largest home healthcare companies account for about one-quarter of the growing US market (per ranking data from LexisNexis MarketView), well-known names like Kindred at Home and Bayada Home Health Care operate alongside many small home healthcare agencies, including those that operate locally or regionally or that serve a specific niche.

Several dominant trends are accelerating demand for home health and home care services, fueling the industry’s strong growth. These include:

-

- An aging population, with the 65+ segment expected to account for some 20% of the US population by 2050, representing a total of over 85 million people

- Rising life expectancies which result in more people facing age-related health conditions like Alzheimer’s disease, afflicting over 6 million Americans aged 65+

- The rising prevalence of chronic conditions across all age segments, including diabetes, cardiovascular disease, and other conditions that require ongoing treatment and care

- Increasing interest in aging in place as an alternative to assisted living and skilled nurse facilities, both for cost reasons and for an improved living experience

- A growing desire for personalized and holistic care, encouraging patients to seek home-based services that offer more tailored and comprehensive care solutions

- Numerous home healthcare advantages that payers, providers, and patients appreciate—from better health and functional outcomes to greater comfort and flexibility, lower care costs, and reduced risk of infection or other complications associated with inpatient care

- Constrained hospital capacity, leading many health systems to shift care to alternatives sites (including the home) to free up beds for higher-margin cases

As a result of these demographic shifts, health trends, and consumer preferences, opportunities abound for home health businesses to expand their offerings and grow market share.

For instance, many agencies are equipped to provide complex or specialized services at home, such as infusion therapy, ventilator care, dementia care, and hospice care. Others are providing products that are essential to receiving and monitoring care at home, like wearable sensors, heart rate monitors, home dialysis or respiratory equipment, and portable oxygen concentrators. And numerous software and technology providers are offering solutions that facilitate operational tasks like scheduling and billing, or tech-enabled services such as telehealth platforms for monitoring patients remotely and advanced analytics that help to monitor and assess trends, risks, and opportunities.

At the same time, new partnerships are springing up to improve home care quality and continuity across the patient’s journey. Some agencies are joining forces with hospitals, health systems, and provider networks, while others are collaborating with community-based organizations and social services agencies to address the Social Determinants of Health (SDoH).

Despite these significant tailwinds, businesses in this sector face a myriad of challenges. Increased demand is drawing new competitors into this sector, some offering novel home care solutions. For example, DispatchHealth provides on-demand urgent care services at home, dispatching its clinicians and technicians via a fully-equipped vehicle.

Meanwhile, reimbursement pressures—including those stemming from the new Patient-Driven Groupings Model (PDGM)—can hamper cash flow and increase documentation burdens. Though the Centers for Medicare and Medicaid Services (CMS) estimates Medicare payments to home healthcare agencies will increase in the aggregate by 0.8 percent in 2024 (per its final rule issued November 1), evolving reimbursement rules make it challenging to maintain a profitable, cash flow-positive agency. Persistent labor shortages have hit the home healthcare industry especially hard, particularly given the prospect of relatively low wages and limited advancement opportunities for home caregivers, while staff departures post-COVID only add to the imbalance between supply and demand. High inflation continues to drag down margins. Complex regulatory requirements can impact patient eligibility for home care and the associated reimbursement, as well as care quality requirements and accreditations. And keeping up with the technology and other infrastructure required to coordinate, monitor, and evaluate home care delivery can prove extremely difficult.

Yet, these challenges have not dampened investor interest in home healthcare businesses. They see too many opportunities to capitalize on skyrocketing demand, provide value-add services that meet evolving patient and payer needs, expand into new markets, and achieve economies of scale and efficiencies through consolidation. As a result, M&A activity in this sector is projected to remain strong for some time.

Ready to Discuss Selling Your Home Healthcare Company?

Chapter 3

Key Players in the Home Healthcare M&A Market

The home healthcare industry is consolidating rapidly as investors acquire smaller, attractive target businesses. Strategic and financial buyers are highly active in the space, drawn by strong growth forecasts and the opportunities resulting from the industry’s transformation.

For strategic acquirers, the industry represents a major opportunity to leverage their core capabilities, substantial resources, and existing networks to expand their offerings and deliver greater value to patients and payers. Through consolidation, strategic buyers can achieve increased efficiency and greater economies of scale, while tapping new market or customer segments and gaining new referral sources.

Among the many large strategic acquirers active in the home healthcare space, a few of the most noteworthy include:

- Amedisys, one of the largest home health, hospice, and personal care service providers in the US, which acquired AseraCare Hospice

- LHC Group, also a top home health, hospice, and personal care service provider, which acquired Heart of Hospice

- Humana, one of the largest US health insurance companies, which acquired Kindred at Home

- CVS Health, which now owns Signify Health, a value-based care provider of in-home health evaluations

- UnitedHealth, which acquired home health and hospice services provider LHG Group as a means to expand its home care services

On the private equity (PE) side, 2021 proved a record-breaking year for home healthcare M&A. Though there are concerns the US federal government’s efforts to restrict PE ownership of nursing homes might eventually impact their activity in the home healthcare space, for now experts expect PE groups to remain highly acquisitive in this field. PE groups with healthcare specialties see opportunities to add strong home care businesses to their portfolios, leverage their industry-specific expertise to improve their portfolio companies’ operations and financial performance, and fund new innovations that respond to emerging healthcare trends.

Some of the most active PE groups in the home healthcare sector include the following:

-

- The Riverside Company, owner of Best Life Brands, a holding company with senior care brands like ComForCare, At Your Side, CarePatrol, and Blue Moon Estate Sales

- Gemini Investors and Plenary Partners, two middle market-focused firms that together own Always Best Care, a home care franchise company spanning 30 states and Canada

- TPG Capital, one of the largest PE firms in the world and owner of WellSky, a health care software and business services company serving 15,000+ home health agencies, hospices, and home care agencies

- KKR & Co., which owns BrightSpring Health Services, a provider of home health, personal care, hospice, pharmacy, and telehealth services

- Advent International, which owns AccentCare, a provider of home health, hospice and personal care services, as well as private-duty nursing and care management services. The company has more than 250 locations across 31 states.

Ready to Talk to an Expert?

Chapter 4

Recent Deal Flow and Multiples

Though economic uncertainty, high interest rates, and market volatility can all weigh on M&A activity, the home healthcare M&A market remains fairly active for high quality companies. If you’re considering selling your company in this environment, you will likely have questions about what kind of deal outcome you can expect.

The deal outcome is primarily a function of your company’s valuation (known as your enterprise value) and the deal multiple.

-

- Company valuations in this sector depend on factors like revenue (including how it’s trending), EBITDA (earnings before interest, taxes, depreciation, and amortization), the quality of your services, the mix of services and payers (which impact reimbursement rates and margins), and the potential for sustained growth.

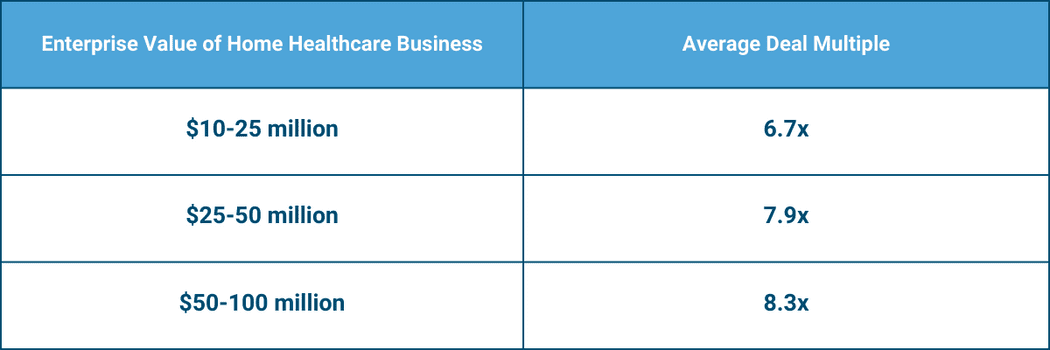

- Deal multiples for home healthcare businesses vary based on similar factors, such as the company’s size, service quality, service mix, and payers involved, as well as its current market position and growth potential. While every deal is unique, with no hard-and-fast rules for the deal multiple you will achieve, recent analysis by GF Data reveals the following average multiples based on a home healthcare company’s valuation.

It’s worth noting that multiples in this sector don’t necessarily correlate with the size of the deal, as recent transactions illustrate. The CVS Health acquisition of Signify Health for $8 billion had a multiple of 10.5x, while Addus HomeCare’s acquisition of Tennessee Quality Care for $106 million had a much higher multiple of 16.5x.

Chapter 5

Factors that Drive Home Healthcare Business Owners to Pursue an M&A Transaction

The decision to take your home healthcare business to market will depend on a number of considerations, all impacted by your personal and professional situation and goals, as well as your company’s maturity stage. For most founders in this sector, the following trends and challenges tend to influence the decision to sell.

-

- Stage of life. One source quotes the average age of a home healthcare business owner at 58. If you’re nearing retirement age, and much of your net worth is tied up in your company, you might be starting to think about cashing in and gaining more time to pursue other interests during your senior years.

- Burnout. While job stress and burnout are high across the healthcare industry, especially post-pandemic, running a home healthcare business can be especially demanding. Pressures like labor shortages, evolving regulations, reimbursement challenges, and rising labor and supply costs make it tough to run a successful home healthcare company. Some founders are ready to turn the reins over to a new owner and alleviate the emotional burden.

- Market conditions. Given the healthy growth and strong consolidation opportunities in this sector, M&A activity is expected to remain relatively strong in the coming years. This environment creates opportunities for owners of high quality home healthcare companies to exit the business and achieve a good deal outcome.

- Succession planning: Some owners find there is no clear successor to take over the business eventually. Perhaps there are no current management team members or family members with the passion for healthcare or the capability to lead the company. In that case, an acquisition might be the best approach to ensuring a smooth transition.

Chapter 6

What Buyers Look for in a Home Healthcare Target Business

While this sector as a whole is appealing to investors for the reasons cited, buyers gravitate toward home healthcare businesses that display certain desirable characteristics. The following are of particular interest to buyers evaluating a target business in this industry.

1. Profitability.

Though strong revenue and top-line growth are essential, buyers lean toward home healthcare companies with better profitability. Those with higher EBITDA will find it easier to attract an investor’s attention.

2. Service quality and mix.

The higher the quality of your services, and the better they match the needs and preferences of today’s patients, the more appealing your business will be. Buyers also consider your mix of services, since that impacts reimbursement rates and margins.

3. Payer mix.

Strategic acquirers and PE groups that specialize in this sector recognize that some payers prove more profitable than others. They’ll review the percentage of revenue derived from commercial insurers vs Medicare/Medicaid vs self-pay patients, the associated reimbursement policies of each payer type, and how each segment is trending when it comes to payments.

4. Current market position.

Home healthcare businesses that are leaders in their geographic areas or market segments, with strong brand recognition and a solid reputation for delivering quality services, will prove more desirable targets.

5. Growth potential.

Demand for services in the geographic areas and market segments you serve, along with your ability to scale efficiently and grow organically by adding locations or diversifying your offerings, all attest to your growth potential.

Chapter 7

What to Consider Before Selling Your Home Healthcare Business

Before you make the decision to take your home health or home care company to market, you need to ensure it’s the right time to sell (both professionally and personally) and your company can be positioned in the best possible light. Activities like the following are critical before embarking on the sale process.

Be clear about your post-transaction plans.

Get your financial house in order.

Buyers expect to see financial statements that are accurate and complete, so do the accounting work now to deliver clean financials when it’s time for due diligence. Beyond the basics like an income statement (also called a P&L), balance sheet, and cash flow statement, you should prepare revenue and expense projections that enable buyers to envision where the company is headed financially. Owners that are serious about selling also invest in a Quality of Earnings report to demonstrate they’re committed to getting a deal done and to facilitate due diligence.

Beef up efficiency and service quality.

Both strategic acquirers and PE groups will examine key operational and quality metrics, such as patient outcomes, customer satisfaction ratings, and customer retention rate, for example. They’ll look for indications that your company operates efficiently, though they also seek situations where they can add value to an otherwise-strong business by improving operations, increasing efficiency, and boosting margins.

Identify your unique value proposition.

Your investment banker will craft a compelling story that ensures your business stands out from competitors, and that demands a clear understanding of what makes you unique. Make sure you have clarity on your key points of difference, whether that’s value-add services, innovative technology, higher quality talent, or other competitive advantages.

Ready to Discuss Selling Your Home Healthcare Company?

Chapter 8

Key Considerations for Growing Your Home Healthcare Business Through Acquisition

Depending on your company’s size and lifecycle stage, along with your personal and professional goals, you might look to accelerate your growth by capitalizing on the consolidation trend and acquiring another home healthcare business.

Before you take that step, carefully examine your goals in pursuing an acquisition. Are you primarily looking to expand into new geographic areas? Do you view an acquisition as an effective way to broaden your offerings? Do you see it as a means to combat labor challenges, strengthen your technology infrastructure, or keep up with changing regulatory requirements?

Your goals will guide you as you begin to identify, evaluate, and select the best-fit business to acquire. At the same time, the criteria that strategic and financial acquirers consider when evaluating target businesses in this sector will be very similar to the considerations you should weigh as you embark on this process.

For home healthcare businesses looking to grow through acquisition, the following tend to be critical considerations to evaluate:

-

- Financial and operational feasibility. Of course, you’ll need to ensure you have the capital to acquire a good-fit target company and can service any associated debt. And you’ll need to scrutinize the target business’s financials to gain confidence the newly acquired entity has strong potential to drive new revenue while maintaining profitability. On the operational side, consider whether there are natural synergies along with opportunities to improve operational efficiency by integrating the companies.

- Quality and fit. Look for a home healthcare company with a diverse and loyal customer base, a strong reputation for delivering high-quality services or products, a highly qualified and skilled workforce, and a culture that is compatible with your own. If expanding your offering is a key goal, seek a target company that can provide innovative solutions that complement your offerings or fill gaps.

- Legal and regulatory implications. Your due diligence should include verification that the target company complies with the many laws and regulations that govern home healthcare, such as licensing, accreditation, reimbursement, privacy, and quality standards. It’s also important to identify risks or liabilities which the deal could trigger, like antitrust claims or other litigation.

Chapter 9

How to Raise Capital for Your Home Healthcare Business

Though the home healthcare M&A market remains active, for various reasons you might decide it’s not the ideal time to sell. Instead, you might seek to secure capital to fund your growth or to capture some of the liquidity that’s tied up in your business. Raising capital might be the best next step and an ideal precursor to selling the business when the time is right.

The two primary options you’ll have are debt capital and equity capital. Each offers advantages and disadvantages, and each is ideal for certain circumstances or goals.

Other factors weigh into the decision to use debt vs equity to raise capital. Home healthcare businesses with relatively stable, predictable revenue and cash flow might find it easier to service debt than companies whose operations are more volatile. Alternatively, home health companies with a high debt-to-equity ratio might find it feasible to use equity financing to reduce their financial leverage and risk. The regulatory climate and current reimbursement policies also can affect a home healthcare business’s ability to obtain debt financing, due to the associated impact on cash flow and profitability.

Companies that are well-positioned to respond to the accelerating need for home healthcare services by offering innovative solutions and high-demand services will find it easier to attract equity financing than those whose businesses are stagnating. Conversely, businesses that need capital to expand into more profitable markets or invest in resources to stay current and competitive might do better seeking debt financing.

Raising capital is complex in any sector, so it’s imperative to have a knowledgeable partner as your guide. Home healthcare business owners should consider hiring an investment banker to help achieve the best capital raise outcome. Your investment banking partner will ask about your capital goals and how you plan to use the funds, then recommend the best capital structure to achieve your objectives, market your business to the right capital sources, and negotiate and finalize the best terms.

The Forbes Guide to Middle Market Capital Formation is an informative and comprehensive resource for business owners that are looking to raise capital.

How Forbes Partners Can Help

With so many tailwinds working in its favor, the home healthcare sector continues to enjoy robust growth, attracting the attention of strategic and financial acquirers. High quality businesses in this sector will likely find it’s a good time to take the company to market—and Forbes Partners is the right choice to guide you to an exceptional outcome.

The investment bankers at Forbes have vast M&A experience in healthcare generally and the home healthcare industry specifically, and we know the buyers who are most active in this space. Our most recent home healthcare transactions include serving as the advisor to Evergreen Home Healthcare in its acquisition by Aveanna Healthcare; advising Options Home Care in its acquisition by Addus Home Care; and representing Summit Home Health Care in its acquisition by Human Touch.

The Forbes team understands what it takes to run and grow a home healthcare business, because we have a proven track record of doing it ourselves. Our healthcare advisory team includes Dan Roth, who was part of the founder team at AccentCare, now one of the largest home healthcare organizations in the country. Dan served as president of AccentCare.com and senior VP of AccentCare and was on the executive leadership team at Apria Healthcare, the nation’s largest provider of home respiratory care and durable medical equipment (DME). Our team also has deep experience buying home healthcare companies, which gives us invaluable insight into how buyers approach acquisitions in this sector.

The Forbes team is especially adept at crafting a strong story about our clients’ home healthcare businesses and creating a unique and defendable position that helps them achieve an optimal outcome. Owners that aren’t ready to sell also find our advisory services invaluable in positioning them for an optimal deal outcome when the time is right.

Talk with Forbes.

Exceptional home healthcare businesses need an exceptional investment bank. Forbes Partners has the necessary expertise and will focus its efforts towards achieving optimal outcomes for you.

Forbes Partners is an award-winning middle market investment banking firm focused on driving maximum value to clients. We help our clients restructure debt or recapitalize their business to meet evolving needs. Many owners desire liquidity while still maintaining control of their businesses. Forbes Partners can help them achieve their goal. Our experienced bankers think strategically about value creation — we are market makers, and our clients expect nothing less.