Bakery and Confectionary Overview

The bakery and confectionary industry in 2024 enjoyed strong growth, driven by evolving consumer preferences and advancements in manufacturing technologies. Private label manufacturers have become pivotal players, as retailers and foodservice companies expand exclusive offerings to cater to price-conscious yet quality-focused consumers.

This trend has resulted in an active M&A landscape, where buyers compete for scalable, efficient manufacturers with diversified customer bases and the ability to produce innovative products.

At the same time, challenges like rising input costs, regulatory pressures, and sustainability demands are impacting operations and creating financial and competitive risks for owners. These challenges are fostering an environment where more and more sellers are looking to de-risk by partnering with and/or selling to a strategic partner.

Buyers are targeting manufacturers that demonstrate resilience and adaptability, while sellers benefit from a competitive environment that drives strong valuations, especially for assets with unique capabilities or strong operational efficiencies.

Key Industry Trends in 2024

- Private Label: Retailers are prioritizing private label products to boost margins and customer loyalty. This segment has expanded significantly, with healthier and specialty products driving the considerable growth.

- Health & Sustainability: Demand for clean-label, plant-based, and allergen-friendly goods remains high. Manufacturers are also being pushed to adopt eco-friendly packaging and sustainable production practices.

- Rising Input Costs: Key raw materials such as flour, sugar, and butter have seen price volatility, while labor costs continue to climb due to ongoing shortages and wage inflation. These factors pressure margins, particularly for manufacturers operating under fixed-price contracts with retailers or foodservice companies.

- Technology Investments: Automation and digital transformation are critical for maintaining cost efficiency and meeting growing demand, particularly as labor shortages persist.

- Economic Factors: Inflation continues to shape consumer behavior, increasing demand for value-oriented private label bakery and confectionary products. Manufacturers must balance price sensitivity with quality.

- Labeling Transparency: Stricter regulations on ingredient disclosure and nutritional labeling are driving the need for compliance investments.

- Sustainability Mandates: Many jurisdictions are implementing rules requiring sustainable packaging and waste reduction, adding costs to operations.

- Health Guidelines: Manufacturers must adapt to evolving health-related standards, such as limits on sugar content, to meet retailer and consumer expectations.

Buyer Rationale Overview

- Strategic Buyers: Food manufacturers and global brands are acquiring private label targets to diversify revenue streams and capitalize on growth in specialty and health-focused segments.

- Private Equity Firms: Interest in private label manufacturing remains strong, with PE firms consolidating fragmented markets to achieve scale and operational efficiencies.

- Retail Chains: Major retailers like Kroger and Aldi are increasingly investing in or acquiring private label manufacturers to ensure consistent supply and enhance their exclusive product offerings.

- International Buyers: European and Asian firms are targeting U.S.-based private label manufacturers to access a growing market and expand their global footprints.

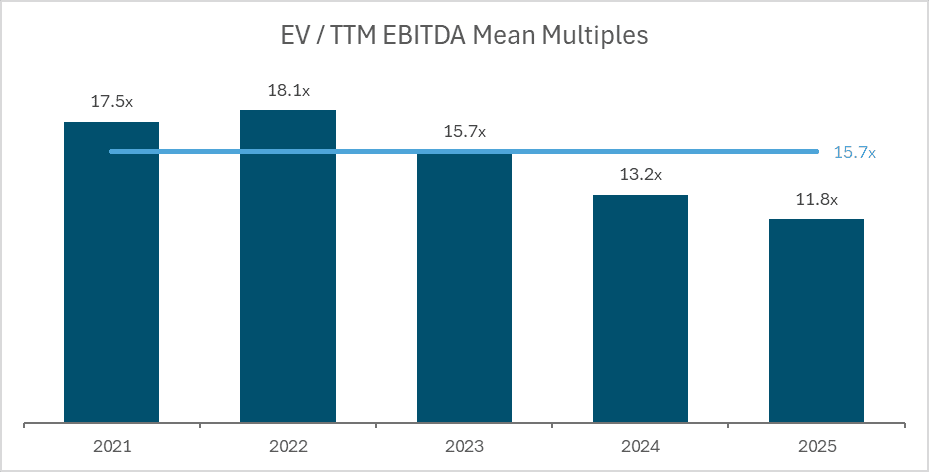

Valuation Multiples

- EV/EBITDA: Private bakery and confectionary manufacturers trade at a discount to large public conglomerates, typically around 6x to 9x, with top-performing businesses achieving 9x to 12x due to scalability, operational efficiency, and specialization.

- Strategic Premiums: Strategic buyers often pay a 15-20% premium for acquisitions that align with their long-term goals.

Premium Valuation Drivers

- Scalability & Efficiency: Manufacturers with advanced automation and capacity for high-volume, diverse product lines continue to attract premium valuations.

- Product Differentiation: Companies specializing in niche or innovative products, such as keto or organic baked goods, are in high demand.

- Sustainability Practices: Strong ESG credentials enhance appeal to buyers, particularly retailers and strategic investors.

- Customer Dynamics: Long-term secure agreements with major customers provide revenue stability, enhancing valuation. Customer diversification reduces risk should any customer changes occur.

- Geographic Reach: Broad distribution capabilities and strategic locations add significant value.

Notable M&A Deals in 2024

- Advent International’s Acquisition of Specialty BakeCo: This deal highlights PE interest in high-margin, specialty-focused private label manufacturers.

- Grupo Bimbo’s Investment in Midwest Bakeworks: Grupo Bimbo’s acquisition reflects strategic expansion into regional private label markets with a focus on clean-label production.

- Sysco’s Partnership with Greenline Baking: Sysco’s partial acquisition demonstrates foodservice buyers’ growing reliance on private label manufacturing partnerships.

These transactions underscore the appeal of bakeries with scalable operations, diversified customer bases, and alignment with industry trends.

In conclusion, M&A in the bakery and confectionary industry offers promising avenues to stimulate innovation, enhance operational efficiency, reduce risk, and bolster companies’ market positions. It is especially crucial for small and medium-sized entrepreneurs (SMEs) to remain open-minded about the potential benefits of M&A opportunities to help accelerate key strategic initiatives that can be supported by a well-capitalized partner.