Overview

The financial markets and M&A markets have both seen recent changes tied to the inflationary economy and the Federal Reserve’s response by raising interest rates. But the biggest changes may be happening in the debt markets where changes in interest rates and overall appetite for risk is causing more direct and rapid changes.

The Changing Face of Banking

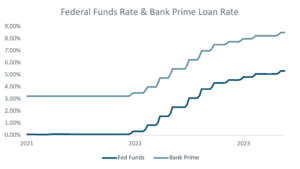

We are coming out of a long stretch of low interest rates and easy access to bank loans business owners. As the Federal Reserve has stepped up interest rates, banks have had to increase their rates in lockstep to maintain lending profits. This means that bank loans that were in the 5% range two years ago are now closer to 10% after pricing in a profit over Prime loan rates.

Interest rate increases are not the only concern for business owners seeking bank loans. The ability to get or renew a bank loan has become more difficult. Banks are in a tough spot given a number of challenges:

-

- Increased interest payments tied to rising rates are putting pressure on their existing small business clients and affecting portfolio performance

- They have fixed rate loans and other financial assets at lower rates but increasing deposit rates that are not being entirely offset by new loans

- Certain pockets of the economy, like commercial real estate, are having a large impact on some banks’ portfolios

With recent bank failures, like SVB, the regulators are taking extra care as they look at banks and banks are following suit. New bank loans and loan renewals are harder to get and more costly than they have been in years.

The Emergence of Non-Bank Lenders

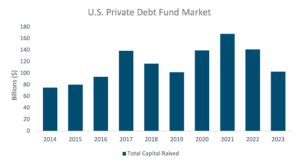

While banks have been the primary source of lending for businesses historically, the last ten years have seen the rise of non-bank direct lenders. These lenders don’t rely on deposit accounts or Federal Funds for capital. Their capital comes from private investors and is often raised at a fixed cost. So, unlike banks, their capital costs have largely remained the same during the recent inflationary period.

The non-bank market has traditionally solved two problems:

-

- Companies that need more than a bank will lend

- Mezzanine lenders provide capital above and beyond a bank loan and take a subordinated position

- Unitranche lenders replace a bank loan with a larger loan from a nonbank lender

- Situations where a bank won’t lend

- Newer companies without the collateral or track record for a bank loan

- Cyclical industries that banks have a hard time managing covenants

- High growth companies that have large working capital needs and reinvest most of their earnings to support that growth

- Companies that need more than a bank will lend

Today, the non-bank market is solving a third problem: providing capital for companies that traditionally relied on bank financing but are no longer able to do so.

Analyzing the Bifurcated Market

All of the changes listed above are having an interesting effect on debt markets and the types of debt financing that companies are utilizing.

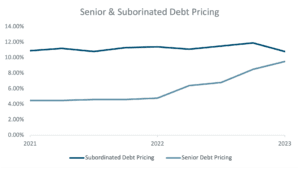

1. Interest spreads are narrowing. While bank rates are increasing, non-bank rates are holding relatively steady. The spread between rates that used to be 7-10% is now closer to 2-5%, which makes non-bank financing more attractive relative to bank financing.

2. The direct lending market is more active than ever. With banks tightening their lending requirements and making fewer and fewer loans, more businesses than ever are having to look for alternative sources of capital. The competition for non-bank lending and the number of opportunities these lenders are looking at is at an all-time high.

3. Cash flow is a focus for business owners. With increased bank interest rates, businesses are having to take a close look at interest payments to make sure they can still afford the costs of their loans. Direct lenders have traditionally offered loans with less amortization than banks to help offset payments tied to their higher rates. That benefit is even more important in a tight economic environment.

Navigating the Competitive Debt Landscape

There are pros and cons to this shift in debt markets. The disadvantages are more plain to see: higher rates, higher payments, and more strict loan underwriting requirements.

But there is still a lot of activity in the debt markets. Direct lenders are raising record amounts of capital that need to be deployed. PitchBook’s H1 2022 Global Private Debt report shows that, in 2021, private debt managers had around $161.9 billion in dry powder. In the first half of 2022, that figure was at $168.7 billion.

The loan structures offered by direct lenders are often much more flexible than those of commercial banks that are highly regulated.

However, there is significant competitive pressures to get funding from these direct lenders. Loans that were traditionally done by banks are now moving to the next class of non-bank lenders. And the loans that this group were providing are moving down market to higher rate lenders, and so on.

Impact on Mergers and Acquisitions

The M&A markets are feeling pressure from rising interest rates and fewer bank loans as well. Private equity typically relies on debt financing to help support acquisitions and these shifts are causing them to work harder to find debt financing and be more cautious in deal structure, valuation and due diligence given increased costs. This has slowed down the M&A activity but good deals are still getting done and private equity funds have been working with non-bank lenders for years.

Summary

There is a lot of noise and confusion in the economy and debt markets today. And business owners are feeling the pinch as they focus on driving long term growth. The silver lining may be in the rise of the direct lending market. Bank rates will eventually return to a more comfortable place and banks will become active lenders once the economy begins to settle. The good news for businesses, whether selling or financing growth, is that there is still debt capital available and there are lenders actively putting money to work. It is more important than ever to know where to look for capital and how to run a robust competitive process to achieve a successful transaction.